Why Invest With Us

Why Invest With Us

Dedicated Relationship Manager

Trust & Long-term Relationships

Process Driven

Periodic Portfolio Review

A Dedicated Team Of Experts For You And Your Growth Story.

At Moneyworks4u, we don't measure experience in years but in the countless life transformations, we've witnessed. As a qualified AMFI Registered Mutual Fund Distributor with over 10 years of expertise, we take a calm, objective approach to your financial situation, helping you plan for life's major goals—retirement, children's education, travel, and more. We act as your emotional anchor, guiding you through market extremes and safeguarding you against impulsive decisions. Our team conducts thorough research, tracks markets, and manages portfolios, allowing you to focus on what matters most—your family, career, and hobbies. In an age of information overload, we cut through the noise and set realistic expectations for returns and risk. With a disciplined, objective advisory approach, we provide customized wealth strategies tailored to your unique needs. Join us to build a wealth generation and protection plan that offers you the best chance to achieve your financial goals.

Our Achievements

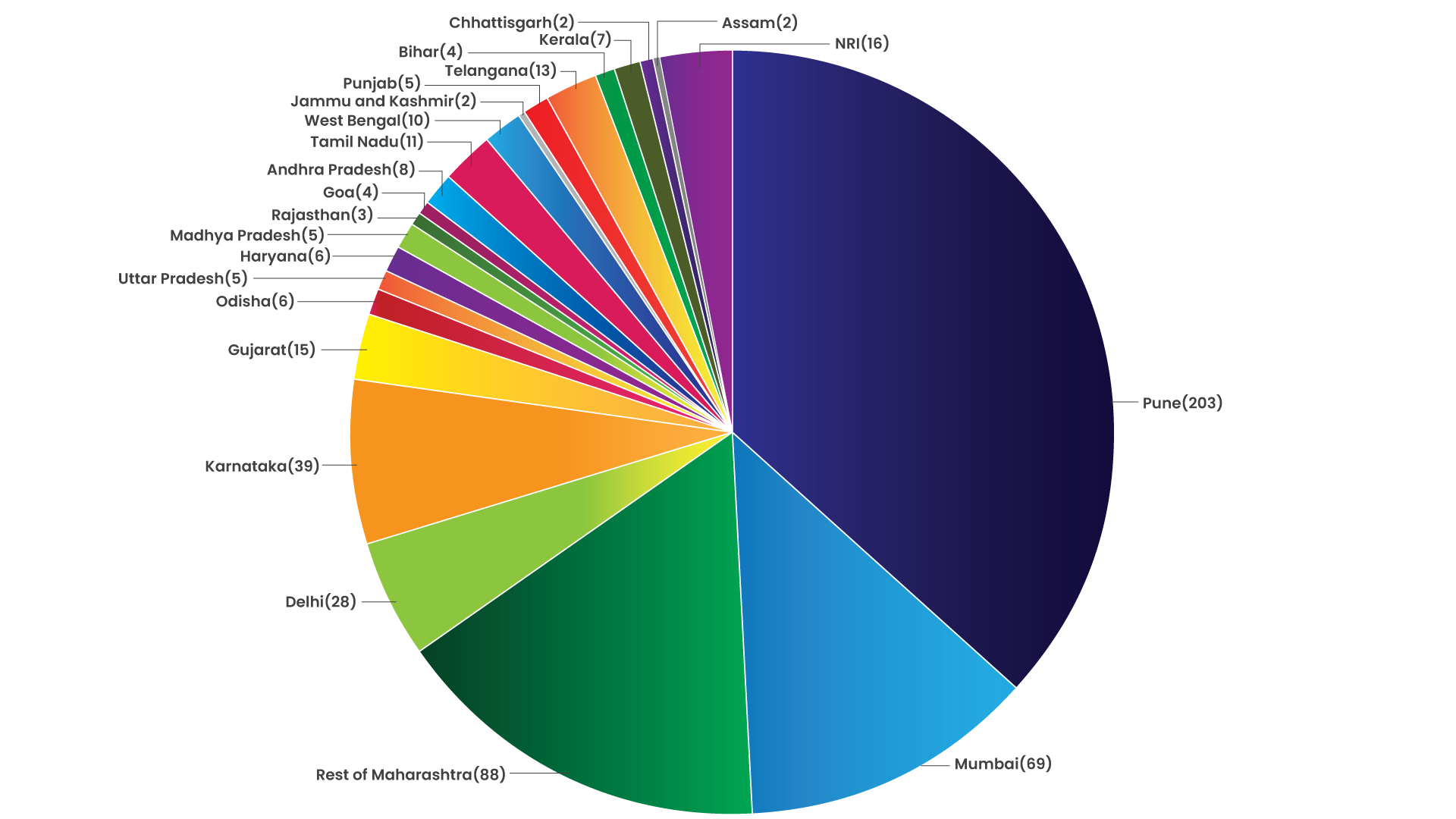

Trusted Families Worldwide

AUM management

We handle your wealth, you live your life.

At Moneyworks4u, an AMFI registered Mutual Fund Distributor based in Pune, we don’t measure our experience by the number of years alone but by the life-changing financial journeys we've helped shape. With over 16 years of expertise, we guide individuals, families, NRIs, and HNIs through every stage of their financial life—from SIP planning and tax-saving investments to retirement and children's education goals. Our calm and research-driven approach helps you stay focused during market highs and lows, protecting you from impulsive decisions and emotional investing. We believe wealth creation is not just about returns—it’s about having the freedom to focus on what truly matters: your family, career, and passions. In a world flooded with financial information, we simplify the complex, provide realistic expectations, and deliver personalized, goal-based investment strategies. Our disciplined review and portfolio management process ensures your plan evolves as your life does. Join us to experience trusted, objective, and consistent wealth guidance designed to give you the best chance at achieving long-term financial peace of mind.

Why invest in mutual funds?

Professional Management

A mutual fund is managed by full-time, professional money managers who actively buy, sell, and monitor investments. This ensures consistent portfolio management, addressing the limitations of investors who may not have the time or resources to conduct research.

Risk Diversification

Purchasing shares in a mutual fund allows you to spread risk by investing in various assets and securities, such as gold, debt, and equities. Diversifying your portfolio helps offset one asset class's risk, ensuring that other investments remain unaffected and even improve in value if one element experiences volatility.

Better Liquidity

Open-ended mutual funds offer high liquidity and are more liquid than life insurance, infrastructure bonds, and post office schemes. They allow investors to redeem units on T+3 and offer superior liquidity compared to other investment alternatives like life insurance plans and government small savings schemes.

Tax Benefits

Mutual funds offer significant tax advantages over conventional fixed-income investments. Short-term capital gains in equities are taxed at 15%, while long-term gains are free up to Rs 1 lakh per fiscal year before 10% tax. Non-equity funds have long-term gains taxed at 20%, while short-term gains are taxed at the personal income tax rate.

Low Cost

Mutual funds offer low expense ratios due to economies of scale, resulting in low running costs and reduced operating expenses like administration, management, and advertising.

Testimonials

My portfolio, which included tactical bets and core portfolio, has performed really well, beating the index.

Apart from portfolio performance, I am also really happy with their timely customers service. They provide prompt response to the queries.

To anyone who wanna invest with Moneyworks4u, I would say that if you decide to invest with them, please plan to be stick around for atleast one bull-bear cycle instead of looking for short term association. A complete cycle would give you a better idea of their performance.

Moneyworks4u... is now a part of my journey.

Thank You for your prompt guidance and support.🙏

Regards Mahendra

There is a constant evaluation and updating of literature regarding the investments and economic outlook.

- Best wishes to them

- Harish Rawat

I am investing with Moneyworks4u since last 1 year and plan to stay invested for long duration for reaching my targets. Mr Sandeep guides time to time with probable investment opportunities along with sharing finance knowledge.

Stay invested long and money will work 4 u

What Our Clients Saying ?

Sudhir Khurana,

Rahul Bhaskarwar,

Hariharan Krishnan,

Payal Gunaki,

Neha Joshi,

Why invest in mutual funds?

Our Latest News & Blog

Sandeep Kulkarni

(MBA Marketing)

Founder & CEO

CONTACT US

Frequently Asked Questions

-

+What are the types of mutual funds?Broadly there are two types of mutual fund categories: Equity & Debt. There are various combinations of these two categories that create hybrid funds.

-

+Why are mutual fund investments better than other investment products?In mutual funds your funds are managed by a highly qualified industry expert with 10-20 yrs of experience. Mutual funds are liquid and you can make full or partial withdrawal from it. Mutual funds give you the opportunity to invest in a diverse portfolio with minimum investment amount, mutual funds are less volatile than stocks, mutual funds offer the highest return on effort as an expert is managing the money, you don’t have to spend time tracking portfolio and Mutual funds are cost effective.

-

+What is the risk of investing in Mutual Funds?Mutual funds NAVs fluctuate as per market movement and there is possibility of making a notional loss in the short term. Mutual funds can not be pledged to take a big loan.

-

+Are there any tax benefits in mutual funds?Capital gains arising for within portfolio changes don’t attract short term capital gain tax, the taxation of equity mutual funds is 10% if held for over a year.

-

+Is it a good time to invest in mutual funds?Yes, any time is a good time to invest in mutual funds. We can choose mutual funds according to your investment horizon right from a few days short term parking to long term financial goals.

-

+What returns can be expected from Equity oriented funds?There are no guaranteed returns in equity mutual funds. The returns depend on the time horizon and market performance. Short term returns can fluctuate a lot and can even go negative. But over 10+ yrs time the probability of making double digit returns is very high. In the past the Nifty TRI returns have been around 14% pa if stayed invested for over 10+ yrs.

-

+Can I plan to save for my future financial goals using mutual funds?Yes, you can save for your child’s education/marriage using children benefit funds, and you can plan for your retirement using retirement funds. Such solution oriented funds are good as the funds get earmarked for a specific financial goal.

-

+What is a Systematic Investment Plan and what are its benefits?SIPs are similar to recurring deposits where you invest a fixed amount in a designated fund every month. We can set up an auto-debit from banks so that a certain amount is saved every month and invested in mutual funds. SIP ensures you invest in a disciplined manner through ups and downs of the market. SIP has become the go to investment vehical for most retail investor for its convenience and good investing experience.

-

+Will you help us invest in the best performing fund?Best performing funds keep changing. We can help you with creating an appropriate portfolio that suits your temperament, your return expectations and your time horizon.

We Are Digital Marketing Company

There are many variations of passages of Lorem Ipsum available, but the majority have suffered alteration in some form, by injected humour, or randomised words which don’t look even slightly believable. If you are going to use a passage of Lorem Ipsumt.

Quality Link

Building Local Specific Online Marketing

Search Optimization

Search Engine Marketing (SEM)