What are mutual funds?

A mutual fund purchase is similar to purchasing a little slice of a large pizza. A mutual fund unit's owner is entitled to a proportionate share of the fund's gains, losses, revenue, and expenses.

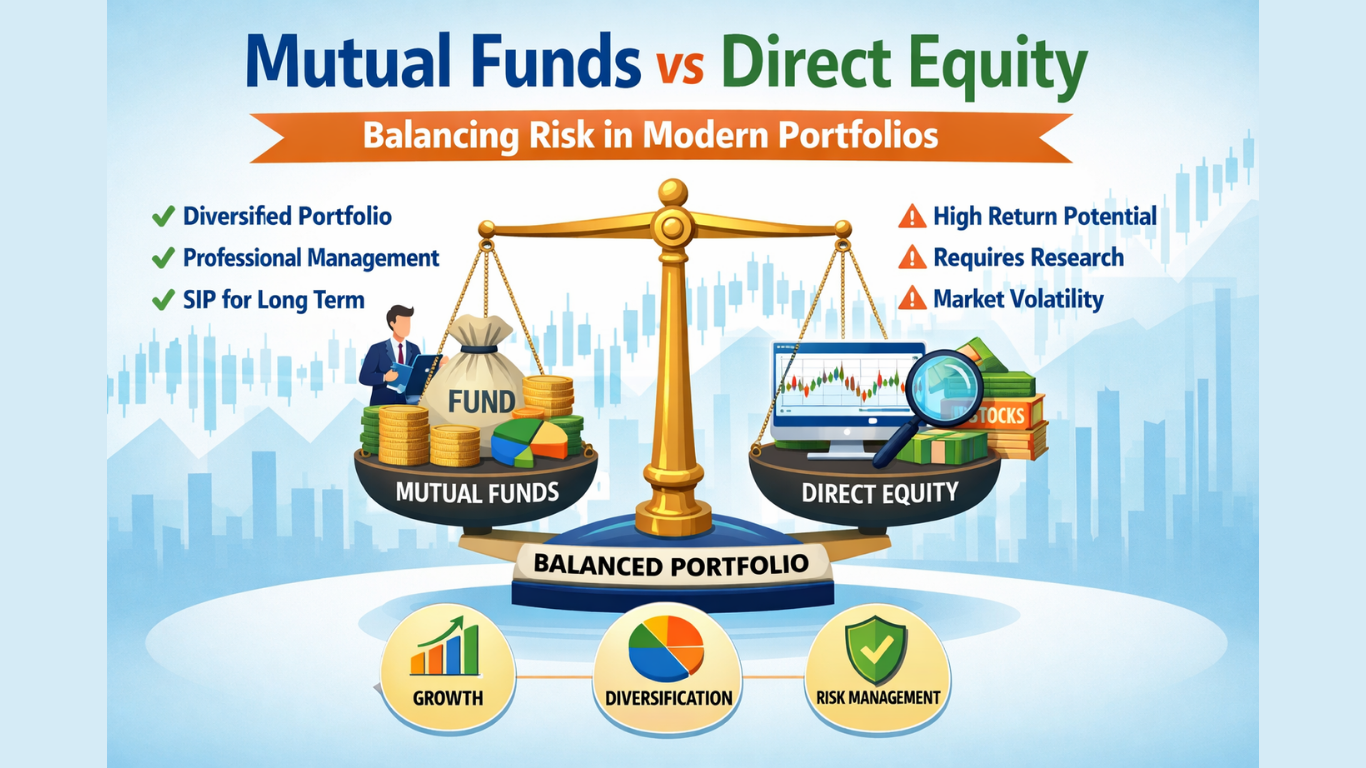

Mutual fund schemes offer a professionally managed, diversified portfolio of stocks, bonds, and other assets. Investing in mutual funds requires planning, establishing investment objectives, selecting the best strategies, and selecting high-return SIP plans and high-growth funds. Guaranteed returns maximize tax savings and protect wealth.

How it works?

A mutual fund is a type of investment vehicle consisting of a portfolio of stocks, bonds, or other securities.

Mutual funds enable small or individual investors to access portfolios that are diversified and professionally managed.

Mutual funds are split into several categories, representing the types of securities they invest in, their investment objectives, and the type of return they are looking for.

Mutual funds may have an impact on their overall returns by charging annual fees, expense ratios, or commissions.

Employer-assisted retirement plans generally invest in mutual funds.

Maximize Your happiness with The Top Mutual Fund Schemes

If you require professional assistance with mutual funds, it is always available. Whether you're a novice or a seasoned investor, you can profit from the advice and insights of qualified experts. Additionally, there are many options available if you're searching for a reliable stream of income, including income funds and dividend funds. So why not learn more about mutual funds today and begin confidently building your wealth?

our latest blogs