One of our clients from Gujarat, based in Ahmedabad, comes from a family deeply involved in real estate and business. His family owns multiple properties spread across Gujarat — commercial spaces, residential units, plots, agricultural land, and different types of properties in multiple cities.

Most of these properties were originally acquired by his father over many years. The family had built a strong real estate base, and on paper, the asset value looked impressive.

However, when the client came to us about one and a half years ago, his concern was very clear.

He didn’t want to continue holding these properties.

Not because he didn’t respect the family wealth — but because he had started realizing something important: most of these properties were not generating any real value anymore.

A large portion of the family’s capital was stuck in assets that were giving:

- No meaningful rental income

- Very low rental yield

- No capital appreciation

- No financial support to his retired parents

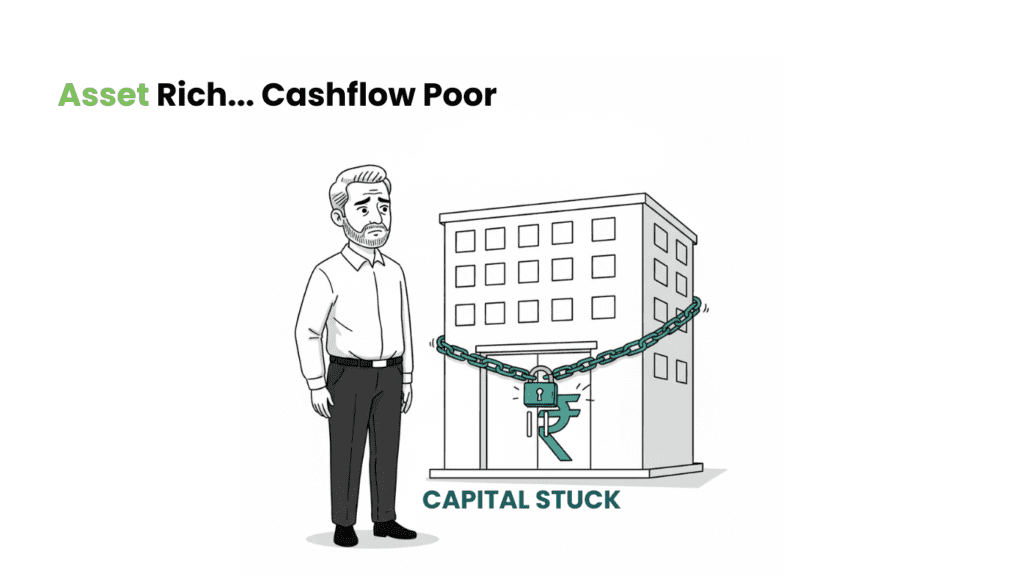

For him, these properties had become dead assets — wealth that existed, but wasn’t working.

The client runs a hotel and other business activities, and he understands cash flow very well. That’s why he wanted a better strategy — one where assets don’t just sit idle, but actually support the family financially.

When he approached MoneyWorks4U, Sandeep Sir and Prathmesh reviewed the overall structure of the properties and his financial situation. After a detailed discussion, we advised him on one key action:

Sell the commercial properties that are not producing income or growth.

Even though the client was emotionally connected to the idea of holding property, he understood the logic. In fact, one of the properties we reviewed had neither capital gain nor decent rental income. Holding it longer didn’t make sense.

So the client made a bold but smart decision.

He sold the commercial property — even though it was at a small loss of around 2% to 3% below the purchase price. But the truth was simple: there was no major capital gain expected from that asset anyway, and continuing to hold it would only increase opportunity cost.

Once the property was sold, the client deployed the funds with us — specifically for his parents.

Our objective was clear:

- Generate stable monthly income

- Maintain liquidity

- Ensure peace of mind for retired parents

- Create a long-term SWP strategy

Considering the current market levels, we felt it was a strong time to start a long-term portfolio. We designed a structured investment plan and started an SWP (Systematic Withdrawal Plan).

Soon, the impact became visible.

The client’s parents started receiving regular monthly income from the portfolio. For a retired person aged 60–65+, this kind of predictable income brings a different level of comfort. Instead of waiting for a property to appreciate someday, they now have a steady flow of money coming into their account every month.

And that was the biggest win.

The client was happy because the family’s wealth had finally started to work.

His parents were happy because they had financial stability and peace.

And the real estate capital that was once stuck had now become productive.

This case is a great example of how the right asset allocation and timely decision-making can transform idle wealth into a stable income solution — especially for retired families

Final Thought

Wealth is not about how much you own.

It’s about how efficiently your money works for you..

If most of your money is locked in assets that don’t generate predictable income, it may be time to rethink your strategy.

Are You Asset Rich But Income Poor?

Let’s evaluate your portfolio and create a structure that generates stability, growth, and peace of mind.

📩 Connect with us to review your financial plan.

Contact Us