Indian investors today have more choices than ever before. With easy access to trading apps, market news and social media tips, direct equity investing has become extremely popular. At the same time, mutual funds continue to attract steady inflows through SIPs and long-term investing.

This raises an important question for investors:

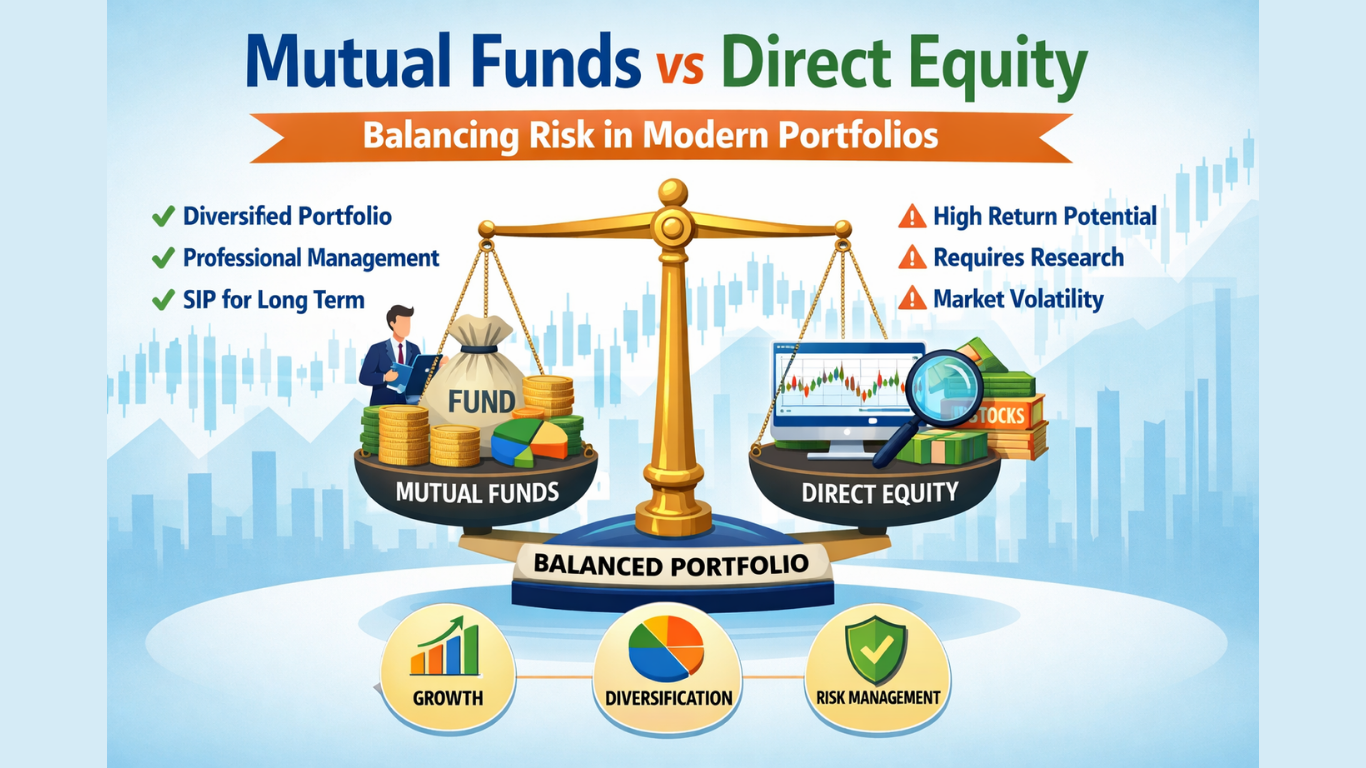

Should you invest in mutual funds or direct equity — or both?

The right answer lies not in choosing one over the other, but in balancing risk intelligently in a modern portfolio.

Understanding Direct Equity Investing

Direct equity means investing directly in individual stocks listed on the stock exchange.

✅ Advantages of Direct Equity

- Higher return potential if stock selection is right

- Full control over buy and sell decisions

- Suitable for investors with strong market knowledge

⚠️ Risks of Direct Equity

- High volatility and concentration risk

- Requires time, research and emotional discipline

- Wrong stock selection can lead to permanent capital loss

- Market cycles can test investor patience

Direct equity works best for investors who:

- Actively track markets

- Understand company fundamentals

- Can handle sharp ups and downs without panic

Understanding Mutual Fund Investing

Mutual funds pool money from multiple investors and invest across stocks, bonds or other assets, managed by professional fund managers.

✅ Advantages of Mutual Funds

- Professional management

- Built-in diversification

- Ideal for SIP-based long-term investing

- Suitable for beginners and busy professionals

- Lower emotional stress during market volatility

⚠️ Limitations of Mutual Funds

- No direct control over stock selection

- Performance depends on fund manager strategy

Mutual funds are ideal for:

- Long-term wealth creation

- First-time investors

- Goal-based planning (child education, retirement)

Mutual Funds vs Direct Equity: Key Differences

| Aspect | Mutual Funds | Direct Equity |

|---|---|---|

| Risk Level | Moderate to High (diversified) | High (stock-specific) |

| Expertise Required | Low to Moderate | High |

| Time Commitment | Minimal | High |

| Volatility Handling | Better | Challenging |

| Suitability | Long-term investors | Active investors |

Why Balancing Risk Matters in Today’s Market

The Indian equity market has seen:

- Sharp sector rotations

- High valuation phases in mid & small caps

- Global events impacting short-term sentiment

In such an environment, putting all money into direct stocks or only mutual funds may not be optimal.

Modern portfolios need:

- Diversification across instruments

- Flexibility to handle volatility

- A balance between growth and stability

The Smart Approach: Combine Mutual Funds and Direct Equity

Instead of asking mutual funds vs direct equity, the better question is:

How much of each should I hold?

A Practical Portfolio Framework

🔹 Core Portfolio (60–80%) – Mutual Funds

- Large-cap, flexi-cap or index funds

- Hybrid funds for stability

- SIP-driven, long-term allocation

🔹 Satellite Portfolio (20–40%) – Direct Equity

- High-conviction stocks

- Sector or thematic opportunities

- Actively monitored investments

This approach helps investors:

- Reduce overall portfolio risk

- Participate in market opportunities

- Stay disciplined during volatility

SIPs vs Stock Picking: What History Teaches Us

Data from Indian markets consistently shows that:

- Disciplined SIP investors outperform most retail traders over long periods

- Emotional buying and selling hurts returns

- Time in the market matters more than timing the market

Mutual funds bring discipline, while direct equity adds tactical opportunities — both have a role when used wisely.

How Risk Profile Determines the Right Mix

Your ideal allocation depends on:

- Age and income stability

- Financial goals and timelines

- Market knowledge

- Risk tolerance

For example:

- Young professionals may allocate more to equity mutual funds

- Experienced investors may add direct stocks selectively

- Pre-retirement investors may reduce direct equity exposure

Final Thoughts

There is no one-size-fits-all answer to mutual funds vs direct equity.

The smartest investors don’t choose sides — they build balanced portfolios that align with their goals, risk appetite and market realities.

Professional guidance plays a key role in maintaining this balance over time.

Need Help Balancing Your Portfolio?

At Aksha MoneyWorks4U Pvt. Ltd., we help investors design goal-based, risk-aligned portfolios using the right mix of mutual funds and equity exposure.

📞 Get a free portfolio review and understand how your investments are positioned for the future.

Contact Us