5 yrs after writing a bullish post calling for a big broad based upmove I want to now play the devil’s advocate by creating a counter narrative to the prevailing narrative across sectors. Please note this is not my market view, I am playing the devil’s advocate here. What markets will do will probably lie somewhere in between what I say in the post and what experts like Mr. Ridham Desai have been saying. The objective of this post is to keep people grounded to reality and not get swayed by story telling.

Narrative: A big Corporate Capex cycle is going to start soon:

I have been hearing about it since 2015. The capacity utilisation levels are still at 75%, we had huge capex

announcements made in 2021 with no follow through action. I wonder why will we see mass scale capex if existing capacities are not well utilised.

Narrative: Discretionary consumption will keep growing at rapid pace:

We saw a massive wage hikes in 2021-22 period which propelled people to upgrade their lifestyle. There were a lot of jobs out there creating a feel-good atmosphere. Today situation is different. IT sector is not hiring, infact the employee count is reducing, start-ups are struggling to raise money. Even if the % of employee who retrenched is very low it creates an anxious work environment. People tend to avoid doing big ticket spends like real estate, cars, travel, etc. 8th pay commission hikes are still 3 yrs away.

Narrative: Real Estate revival will go on for many years.

The prevailing housing prices across major cities are now at 400x-500x months prevailing rent. Its getting unaffordable/unfeasible for many people to stretch themselves to buy a house of their dreams. Just as we have seen inventories evaporate we will see massive inventory build up over next 3 yrs as huge supply is coming in most of the cities. I remember reading this article from Vishal Bhargava, Mumbai alone is going to add such huge inventory. Builders are masters are creating FOMO using media/PR. I will be very sceptical of any bullish headlines about real estate going forward.

Narrative: Private Banks will do well

Banking has become a competitive field with return of PSU banks in the fray. Pvt sector banks are struggling to raise deposits whereas PSU banks are able to do it easily. Banks don’t fund infra project where the biggest growth is happening. Most of the growth is coming from mortgages. RBI has already flagged off risks in unsecured lending. Starts-ups get funded by VC/Angels. Corporate capex is a mirage and most corporates are flushed with cash, they will go to banks so early to borrow? So expecting big loan book growth in

such environment is not a good idea. World over banks/lenders trade at <2x

PB. Its only in India where we expect them to trade at 3x-4x-5x PB.

Narrative: India is big beneficiary of China + 1:

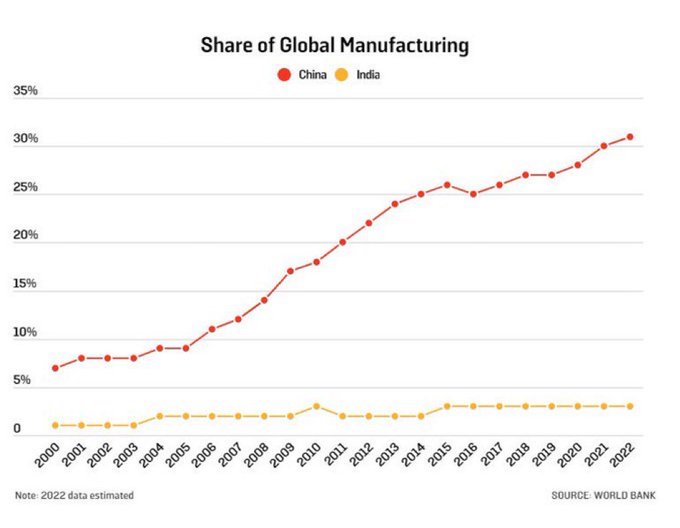

Except for electronics manufacturing we are yet to see big results in other domains. How many MNC have you heard leave China and come to India for setting up their factories? India share of global manufacturing has remained unchanged in past 4 yrs, hovering around 3%. China share of global manufacuring on the other hand went up from 27% to 31%.

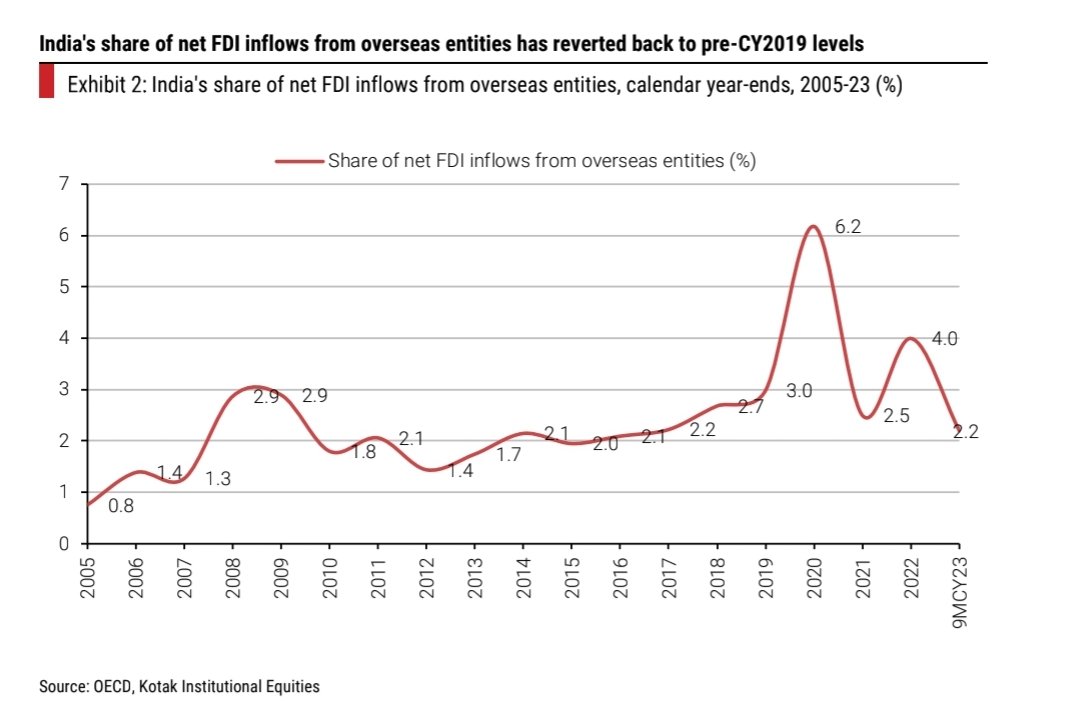

If India was becoming China+1 manufacturing hub we should have seen FDI rise, but instead FDI has gone down.

Narrative: Automobile Demand will remain robust:

I believe a lot of people who want to upgrade their cars will play the wait and watch game to see how the EV scene shapes up in India. If infra becomes accessible across India and if EV prices become competitive. Market is about rate of change. I believe we will sell cars but the growth rate could disappoint. EV could bring in new competition and new winners in that context what is the valuations we should pay for the incumbent.

I feel auto sector stands where telecom sector was 10-12 yrs back. It must undertake massive capex just to remain relevant. It also means the profitability in next decade is going to challenging. We have seen how IPO by industry players marked a multi-year top for the sector(DLF, Indigo paints, LIC, Metropolis H/c).

If whatever I say here comes true, chances of making positive returns in midcap-smallcap funds over the next 3 yrs are bleak. If what Mr. Ridham Desai says comes true we can expect returns in line with long term average of 12-15% over next 3 yrs. My sense is reality will lie somewhere in between. As Mr. Desai’s ex-collegue, Mr. Ruchir Sharma said India will disappoint most optimist and it will disappoint most pessimist.